While African countries seem to be encouraging their farmers to produce for exporting to developed countries, those countries are looking at African countries as their customers. Competition has become so real that it is very easy to find chickens from Brazil and Chinese noodles in remote corners of Africa. This means all producers, including smallholder farmers in developing countries have to keep a hawkish eye on the competitive landscape. Taking advantage of digital networks, producers are forced to creatively imagine how they can participate in a rapidly globalising agricultural market. A good start can be scanning their local market environment.

With digital platforms allowing many farmers to quietly and quickly produce and deliver commodities to the market, pricing pressures are intensifying such that uninformed farmers suffer more than those who are strategically informed. To assist farmers and other agricultural actors, agricultural platforms have to move beyond providing general information to building econometric models based on real-time inflows and outflows of agricultural data in agricultural markets. Data on commodities, traders, farmers, services and finance have to be regularly captured and analysed into rich insights that reveal the contribution of agricultural markets to national GDP. Competitive farmers are not interested in news but market intelligence for decision-making.

Examples of market intelligence that smallholder farmers should strive to get

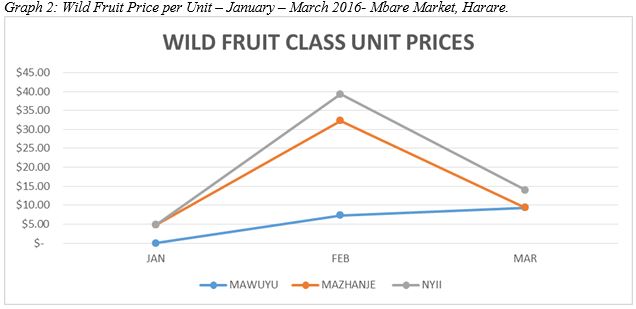

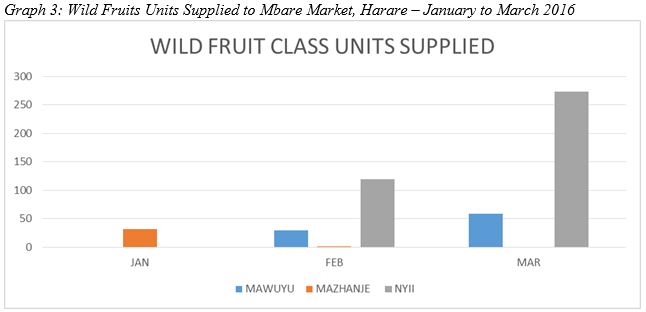

There is always strong competition for consumers between fruits and other commodities such as vegetables and field crops. Farmers are interested in information about wild fruits because the fruits have a strong bearing on the availability and performance of field crops and other commodities in the market.

Building capabilities to compete

As a result of rich analyses, farmers and traders can be empowered to examine complexities and risks surrounding their commodities. From an informed position, they can decide to focus on farm-gate marketing as opposed to taking commodities to urban markets. Like everyone in business, farmers and other agricultural value chain actors have to be always taking a fresh look at their assets such as relationships with customers and market data. To do so, they badly need advanced digital capabilities. Fortunately, most developing countries have a growing cottage industry of young people able to build the digital capabilities of farmers and other value chain actors. Acquiring such capabilities will enable farmers to navigate local and global agricultural markets.

Digital platforms are also enabling consumers to instantly see what is on offer in agricultural markets. This provides opportunities for good agricultural commodities to go viral and be demanded by consumers in corners of the globe that local farmers never imagined existed. Properly organized agricultural markets that leverage on ICTs can provide up-to-the minute visibility into complex agricultural supply chains. This can enable coordination of buyers and vendors in real time. Harnessing digital technology is giving farmers capacity to deal with previously sophisticated traders. Digital technology is also enabling farmers and traders to see what is used to be privileged information held by contract companies and supermarkets. Such insights are empowering their competitiveness.

charles@knowledgetransafrica.com / charles@emkambo.co.zw / info@knowledgetransafrica.com

Website: www.emkambo.co.zw / www.knowledgetransafrica.com

eMkambo Call Centre: 0771 859000-5/ 0716 331140-5 / 0739 866 343-6